Definitely, of the meaning total borrowing from the bank stability improve that have bill of a payday loan, but these significantly persist about half a dozen- to twelve-day several months, after dark average time of a quick payday loan about research (thirty day period).

In the borrowing from the bank agency data a missed payment is known as a beneficial “less than perfect credit experience,” that has every different skipped payments, elizabeth.g., shed the very least percentage due towards credit cards declaration, shed financing instalment fee, or failing to generate home financing repayment from the deadline. You.K. borrowing from the bank records have certain details about non-payment out of domestic expense. Casing rents and local taxes aren’t noticed.

In britain deposit accounts bring “arranged” overdraft constraints, usually that have APRs on the selection of 10% to 20%. In the event that a consumer tries to use outside the overdraft maximum, they incur a penalty payment and you may a market on the borrowing file.

Here we teach 95% rely on intervals, on the caveat these particular visuals don’t need membership from the family-wise mistake rates.

The borrowed funds enjoy speed expands at the large credit rating deciles. From the highest credit rating decile, the new enjoy rates was 75.1%, compared with 66.2% on mortgage acceptance tolerance.

The united kingdom has the world’s second premier pay-day credit around 10% of your own U.K. population removed an online payday loan (4.six million anybody), with ten million payday loans offered to step one.six mil successful individuals. step 1 The new You.K. market is mostly on line (otherwise accessed through mobile programs), helping users to get fund within seconds, generally via automated decisioning possibilities. The online marketplace for cash advance has exploded from the United Claims and that is likely to develop in the future, but really this has been the subject of almost no lookup. dos Our very own data towards You.K. market is for example detailed. The information and knowledge has loan-level facts for everyone cash advance provided when you look at the 2012-thirteen by biggest 30-seven loan providers (with her constituting whenever 99% away from money issued). To possess eleven high loan providers, coating everything ninety% out of financing awarded, the content place also contains information on all applications, rejected and you can approved, in addition to financial credit ratings and you can thresholds for personal mortgage decisions. Private customers are coordinated across payday loan providers and also to their credit bureau files to ensure we could tune for each and every individual through the sector along the one or two-season several months. step 3

Our very own email address details are according to training you to recommend that payday loans aggravate financial hardship ( Melzer 2011; Skiba and you may Tobacman 2015; Melzer 2018). Our very own finding that the means to access payday loans factors customers to take towards the additional credit contrasts that have You.S. studies that see cash advance are substitutes to other forms of credit, a discovering taken from degree one exploit condition-height financing bans ( Morgan, Strain, and you will Seblani 2008; Zinman 2010; Desai and Elliehausen 2017; Bhutta, Goldin, and you can Homonoff 2016). One explanation for it variation is generally you to definitely regarding the You.K. on the web financing sector, of many funds is actually acquired through head machines, which get sell-to your leads to one or more bank (and this potentially creating several loan promote). Our very own abilities and additionally compare for the previous research of the Liberman, Paravisini, and Pathania (2018), whom additionally use U.K. study and acquire one applying for a payday loan gets worse borrowing from the bank ratings (for both winning and you will unsuccessful candidates), however, use of the mortgage has no next effect on creditworthiness. Its research brings towards the investigation out-of one lender (and hence they cannot to see perhaps the applicant obtains a loan elsewhere) one serves just as much as dos.3% of field and you will facts an effective nonstandard loan equipment. 6

We have now give an explanation for lending conclusion out-of You.K. pay-day lenders and how we mine these for character. A lender generally speaking receives a software to have a predetermined rate loan (financing by which the price is not risk-modified on candidate), that can be matched up towards the applicant’s credit file provided with a cards bureau. Almost every other analysis supply can be matched for the application for the loan data. Such, pulled with her, are widely used to determine an excellent lender’s proprietary credit score. Particular software is actually rejected ahead of reaching that it rating phase. 10 The amount of credit score required to become recognized for financing is named the fresh “credit history threshold.” Programs having credit scores below so it threshold try denied. Programs that have credit scores at otherwise a lot more than which tolerance transit the credit score phase onto mortgage approval, or next stages in the decision design (including con evaluation or other checks). And that, financial borrowing-score thresholds manage discontinuities from the probability of obtaining a payday mortgage.

Profile suggests within the committee An effective an RD basic-phase spot on what new lateral axis payday loans Wyoming suggests simple deviations of the latest pooled enterprise credit scores, toward credit rating threshold value set to 0. This new straight axis reveals the possibilities of a single candidate obtaining financing off one financial in the industry within one week of software. Committee B portrays a thickness histogram away from fico scores.

Desk reports pooled local Wald statistics (standard errors) of IV regional polynomial regression prices to have plunge in the consequences variables the lender credit history threshold throughout the pooled sample. For each and every line suggests another type of result variable with each cellphone reporting your neighborhood Wald figure off another type of selection of pooled coefficients. Mathematical significance denoted from the * 5%, ** 1%, and you can ***0.1% account.

Figure 1 illustrates the loan greet rate along the credit history distribution

Figure suggests RD next-phase plots on pooled take to from very first-date cash advance programs. The latest horizontal axis suggests basic deviations of one’s firm credit history, for the credit rating tolerance worthy of set to 0. Brand new vertical axis reveals brand new gadgets of one’s lead adjustable. Each study container signifies a couple of loan requests for the two-season take to months. Suitable regional polynomial regression outlines get both sides of your credit-score threshold.

Because of the results significantly more than, we want to anticipate to to see effects toward consumers’ credit scores

Given that discussed earlier, brand new You.K. borrowing sector does not have a popular single credit score measure (in place of new You.S. FICO get), and you can lenders don’t normally fool around with a cards bureau credit score when making financing conclusion. twenty-five The credit results made available from the credit agency within investigation was current at the yearly volume. We utilize the borrowing from the bank bureau’s fundamental whole-of-markets credit history, of which we calculate the real difference for the credit rating ranging from . Which we could estimate a keen RD model to recoup the fresh jump regarding the improvement in credit rating during the threshold. Brand new estimate, found in the committee C regarding Table step 3, requires a worth of –25.7 situations, and this up against a baseline improvement in credit score on the take to regarding –29.7 factors, implies an 80.1% even more damage in credit rating on account of choosing an instant payday loan. Although not, i add to which impact the caveat one limited recommendations can end up being inferred out of borrowing from the bank agency credit scores in the united kingdom.

Early in the day knowledge document one to a portion of men and women do not incorporate to own credit since they’re annoyed individuals, opting for not to pertain as they desired rejection ( Jappelli 1990). You to definitely effectation of a profitable cash advance app may be to contrary that it impact, prompting the fresh borrowing from the bank applications.

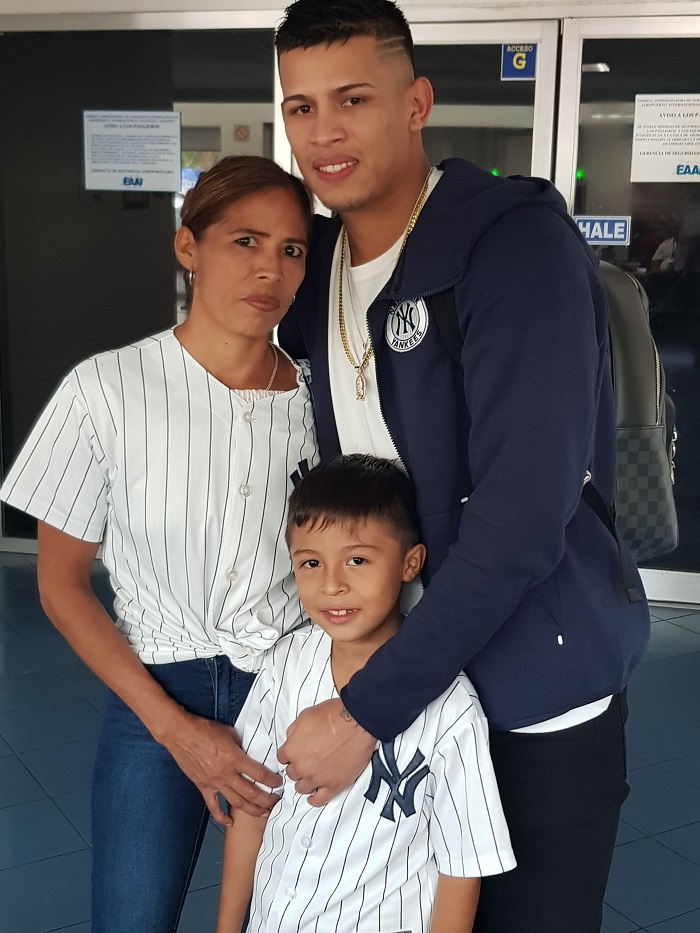

La entrada These studies was simply for household expense one to include credit plans, such as for instance smartphone or electric bills se publicó primero en Juan “D” y Beatriz.

![An American Tail [1986] [DVD5-R1] [Latino]](http://iili.io/FjktrS2.jpg)